If you have any trouble understanding any of the fields, hover over the field for a description of the value requested. Here you can calculate your monthly payment, total payment amount, and view your amortization schedule. If your loan requires other types of insurance like private mortgage insurance (PMI) or homeowner's association dues (HOA), these premiums may also be included in your total mortgage payment. Welcome to our commercial mortgage calculator. Your mortgage lender typically holds the money in the escrow account until those insurance and tax bills are due, and then pays them on your behalf. If you have an escrow account, you pay a set amount toward these additional expenses as part of your monthly mortgage payment, which also includes your principal and interest. The "principal" is the amount you borrowed and have to pay back (the loan itself), and the interest is the amount the lender charges for lending you the money.įor most borrowers, the total monthly payment sent to your mortgage lender includes other costs, such as homeowner's insurance and taxes. Remember, your monthly house payment includes more than just repaying the amount you borrowed to purchase the home. At Swoop Funding, our commercial mortgage calculator helps you estimate your monthly mortgage payments based on factors such as the loan amount, interest rate. These autofill elements make the home loan calculator easy to use and can be updated at any point. Past performance of a security does not guarantee future results or success.Īxos Invest LLC, Axos Invest, Inc., and Axos Bank are separate but affiliated companies.Zillow's mortgage calculator gives you the opportunity to customize your mortgage details while making assumptions for fields you may not know quite yet. Investment risk including possible loss of the principal invested. Insured by the FDIC or any governmental agency, and are subject to Simply enter your preferred loan amount, loan type, interest rate, loan term and payment cycle below to find out what your commercial loan repayments could be. Securities and other non-deposit investment products and servicesĪre not deposits, obligations of or guaranteed by Axos Bank, are not Commercial loan repayments Our commercial loan repayment calculator is here to help you grow your portfolio or commercial business. Read more information about SIPC on the SIPC web page.

All cash and securities held in Axos Invest client accounts are protected by SIPC up to $500,000, with a limit

View the background of this firm, or REVIEW our Form CRS. YOU MAY FIND MORE INFORMATION ABOUT OUR FIRM ON FINRA’S BROKERCHECK. Brokerage services and securities products are offered byĪxos Invest LLC, Member FINRA & SIPC. Information about our advisory services, please view ourįree of charge. Registered with the Securities and Exchange Commission (“SEC”). For more information readĪdvisory services are offered by Axos Invest, Inc., an investment adviser The FDIC from other deposit accounts held with the same ownership and/or Allĭeposit accounts of the same ownership and/or vesting held at Axos Bank areĪll deposit accounts through Axos Bank brands are not separately insured by All depositĪccounts through Axos Bank brands are FDIC insured through Axos Bank. Property Tax: An annual tax paid to the local government based on the value of theīank products and services are offered by Axos Bank ®.Property taxes, and homeowner's insurance. PITI: The monthly mortgage payment that includes amounts for principal, interest,.P&I: The monthly mortgage payment that includes amounts for principal and interest.Loan Term: The number of years a borrower makes monthly payments towards a home.Loan Amount: The total amount you want to borrow from the lender.

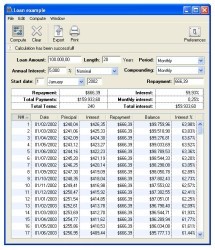

Interest Rate: A percentage of the loan amount paid to the lender.Home Purchase Price: The purchase price of a home.Homeowner's Insurance: A type of insurance that pays for the damage or loss of your home.Maintenance and improvement of the complex. HOA Fees: Monthly fees paid by the borrower to a homeowners association (HOA) for.Fixed Rate Mortgage: A type of mortgage that has the same interest rate throughout.Down Payment: The upfront payment of a portion of the home purchase price.Adjustable Rate Mortgage (ARM): A type of mortgage that has the same interest rateĪllows an annual adjustment to the interest rate after the fixed rate period ends.Simply enter the loan amount, term and interest rate in the fields. Amortization: The process of paying off a debt over time through fixed monthly This tool calculates payment amounts for a given commercial property. Loan Calculator Bankrate Loan Calculator This loan calculator will help you determine the monthly payments on a loan.

0 kommentar(er)

0 kommentar(er)